Trade credit insurance — sometimes called accounts receivable insurance — is different from “insurance” in the traditional sense. It is a credit management tool that helps monitor, prepare, and protect your business from bad debt. It delivers world-class knowledge and data intelligence that empowers your trading decisions. Best of all, it is a guarantee of payment on your receivables. Globally, TCI supports nearly $3 trillion in trade on open terms each year. An estimated 80 to 90% of global trade is supported by some type of TCI.

According to a 2021 report by Allied Market Research, the adoption of TCI accelerated during the economic downturn of 2020, which served as a reminder of the potential for market disruption and lost receivable revenues. The global market for TCI reached $9.39 billion in 2019 and is expected to reach $18.14 billion by 2027, according to the research firm’s projections which represents a compounded annual growth rate of 8.6%.

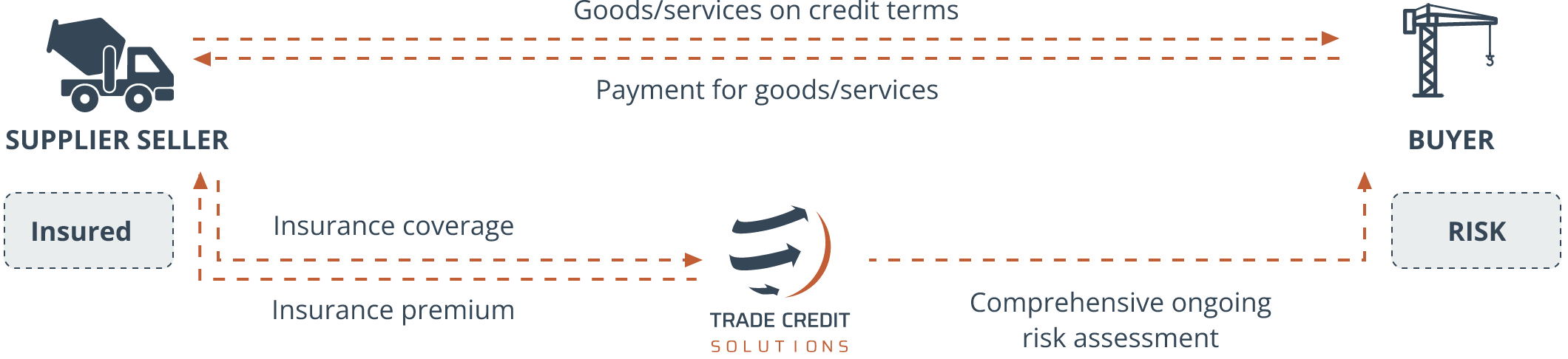

Trade credit insurance provides financial coverage for the losses that can happen when a customer does not pay for goods or services due to bankruptcy, insolvency or if payment is very late.