info@tradecredit.mn

+976 7575 6000

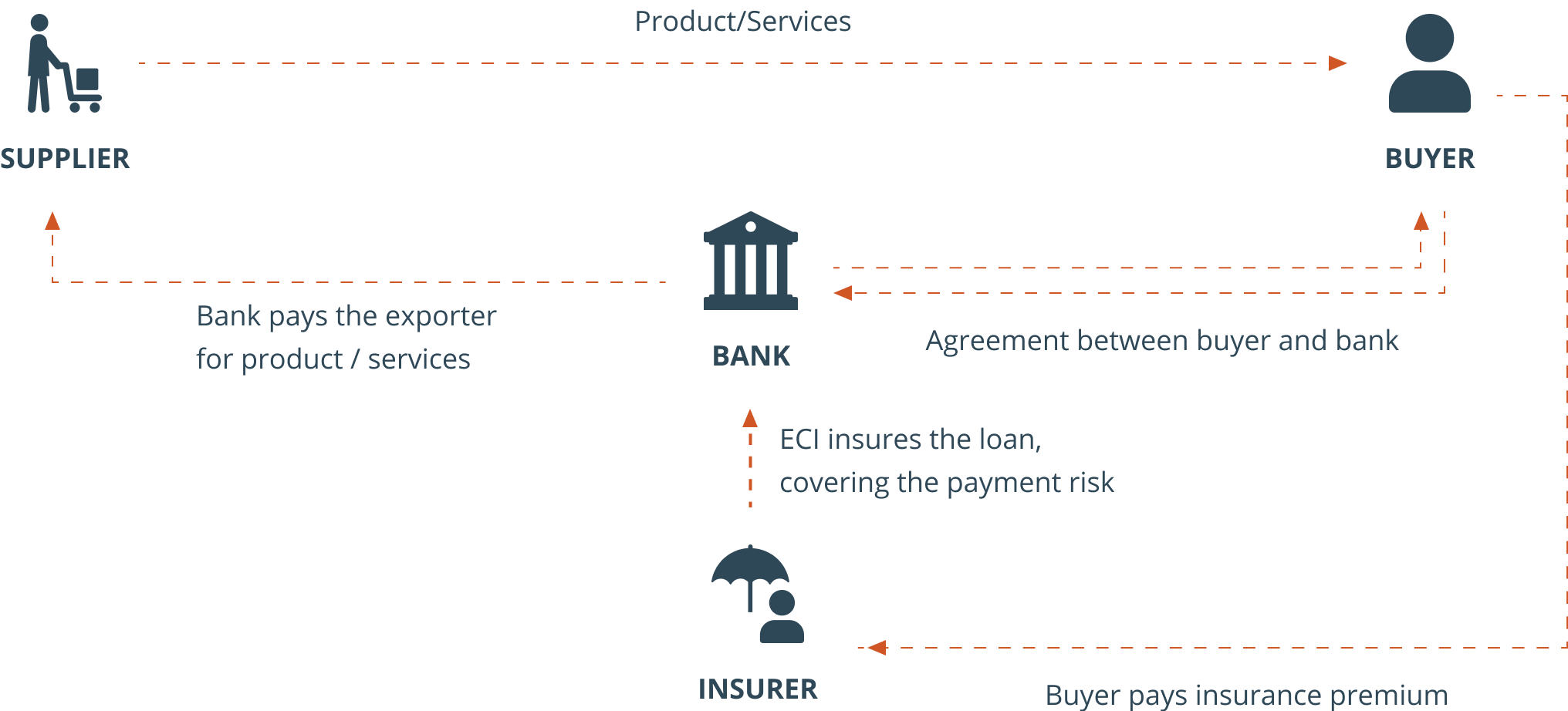

Export credit insurance (ECI) protects an exporter of products and services against the risk of non-payment by a foreign buyer. In other words, ECI significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay.